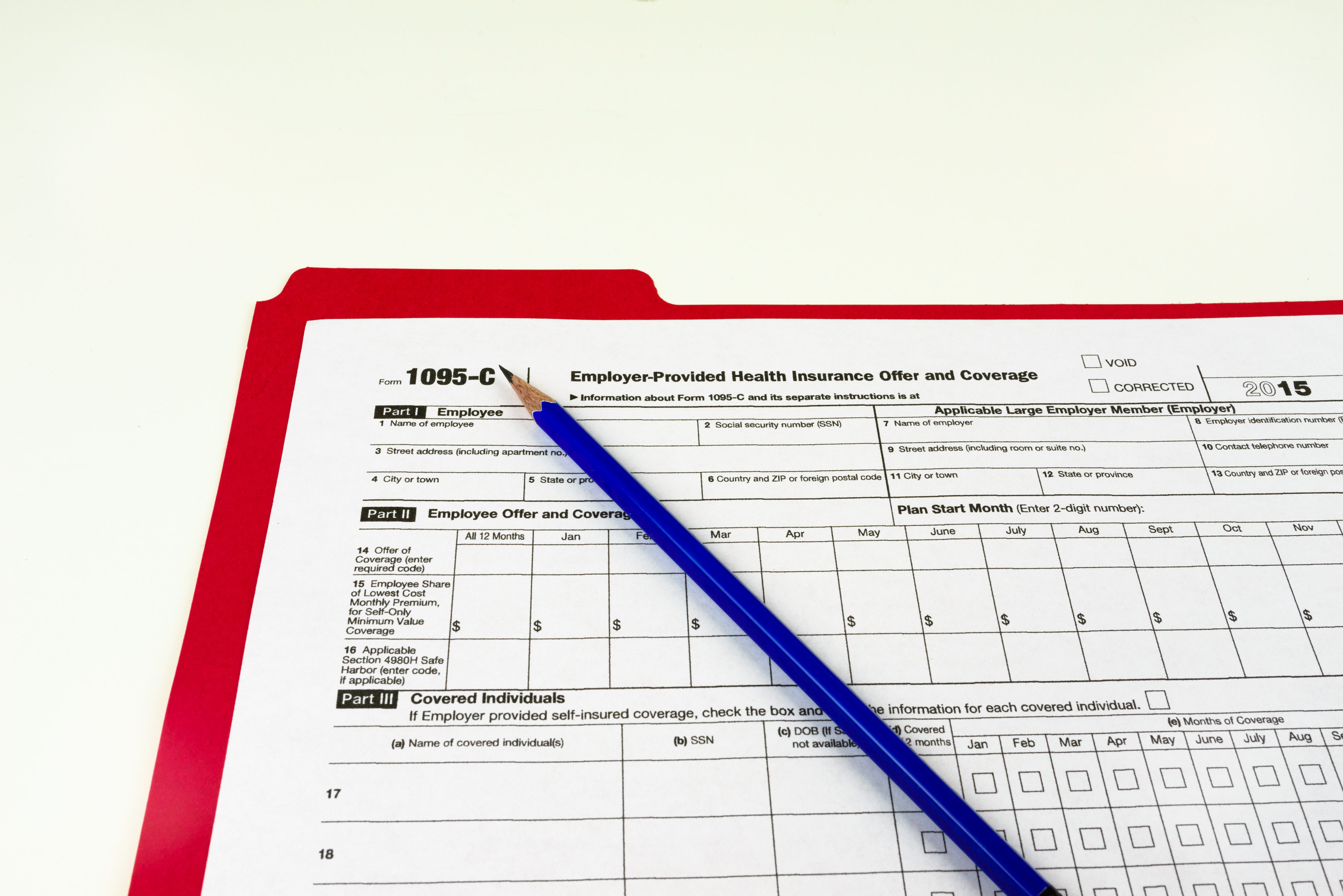

The extended IRS deadline of March 31, 2016 to provide employees with 1095s for ACA compliance has come and gone, leaving two categories of employers:

The extended IRS deadline of March 31, 2016 to provide employees with 1095s for ACA compliance has come and gone, leaving two categories of employers:

- Those who met the deadline

- Those who didn’t meet the deadline

If you fall into category #2, and were late providing (or have yet to provide) 1095s, chances are you are counting on the good graces of the IRS to grant you relief through an exemption based on your “good faith effort” to comply.

The IRS has stated there will be no reporting penalties if the employer makes a good-faith effort to comply, but failed, with providing 1095 and 1094 forms by the deadlines. (The IRS deadline for filing 1094s electronically is June 30, 2016.)

For late 1095s, the burden of proving a good faith effort lies with the employer to demonstrate there was a “reasonable cause” for the delayed forms and not merely willful neglect. To avoid penalties, the employer must demonstrate there were “significant mitigating factors with respect to the failure,” as well as show “the failure arose from events” beyond their control.

While you may be able to demonstrate reasonable cause and avoid penalties, it could become an issue down the road in subsequent years, especially if the IRS observes a pattern of non-compliance.

For the 2016 reporting year, adopt an early-start strategy now, and designate an ACA compliance champion within your organization to ensure steps are being taken to comply and report in a timely manner.

If you do not have an ACA compliance and reporting solution, please consider ACA-Track™, a proven and trusted stand-alone software that collects and monitors employee hours with threshold alerts, and generates and fulfills all IRS-required 1094 and 1095 forms.